Follow on Google News News By Tag Industry News News By Place Country(s) Industry News

Follow on Google News |  Nationally Recognized FINRA Attorney Arbitration Firm Investigating Willow Fund Investments by UBSClosed end fund , the Willow Fund, sold by UBS is closing down in June. Investors were allegedly defrauded by the fund manager, who improperly invested in credit default swaps in Europe and lost 89% of the value of the fund.

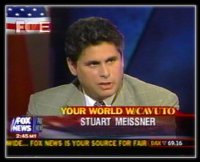

By: Stuart D. Meissner LLC The Meissner firm is known for its record win statistics in arbitration in recovering funds from investors against large investment banks such as UBS. For more information or have a free phone consultation please see: http://www.smeissner.com/ End

Page Updated Last on: Apr 10, 2013

|

| ||||||||||||||||||||||||||||||||||||||||||