Follow on Google News News By Tag Industry News News By Location Country(s) Industry News

Follow on Google News |  Brokerage Firms Using U5s as Leverage Against Brokers and Registered RepsStock brokers and Financial Advisers are increasingly cognizant of the growth of Brokerage firms and wire houses using the threat of marking up someone's U5 and CRD in order to keep them quiet. Having a FINRA Attorney on one's own side is essential.

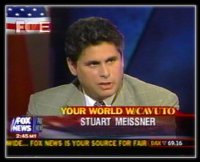

By: Meissner Associates, Attorneys at Law It seems more and more often now firms are threatening reps with filing false assertions on a broker’s U5 when they depart a firm, so as to gain leverage over the representative. When a dispute breaks out between a representative and a firm whether it is because the representative learns of some compliance procedure or SEC rule violation that the firm is permitting and the representative raises it, often times the firm tells the representative to mind his own business. If they don’t and continue to complain they often suddenly find themselves out on the street and some false statement being input on the U4. Unfortunately this has become more of a problem since the Met Life Case in the New York Court of Appeals link http://scholar.google.com/ Recently the New York Post http://www.nypost.com/ As a result the adviser’s only choices to remove the false U5 filings are either to (a) pay an attorney to file an arbitration claim for reformation and expungement of his or her CRD which does not provide for damages, but simply may remove the false assertion after meeting the stringent requirements, and gaining court confirmation of the arbitrators order; (b) attempt to circumvent the Met Life limitation by asserting and proving that the brokerage firm not only filed a false U5, but went around to others and repeated such falsehoods which can be the subject of a defamation claim; or (c) . Further, one can attempt to file an arbitration asserting negligent or intentional infliction of emotional distress, if one can prove such in a FINRA arbitration, preferably with a FINRA Attorney who is experienced with FINRA Arbitrations. The final choice is under recent guidelines promulgated by FINRA in relation to the expanded information on FINRA Brokercheck. as detailed on our Site, http://www.smeissner.com/ Any one of the above choices can in theory be done on one’s own, without an attorney, but by doing so one is starting out behind the eight ball as the representative would not know what is significant and what is not significant in order to obtain the results sought. In addition, pursuing arbitration is not simple, as it is guided by its own set of code provisions, rules and deadlines that the layperson would not realize. At the same time the experienced attorney for the brokerage firm would run circles around the representative. Such is why most pro-se (self represented) Of course as with any change in employment, the representative can always file their own rebuttal when they arrive at their next firm so that both the prior firm’s statements and what the broker asserts appears on the CRD disclosure for investors and regulators to see. Often times this in itself may lead to significant problems for the former firm. One former client provided detailed information contradicting the former firm’s allegation within the U5 and asserted that he was basically a whistleblower attempting to stop violations of securities laws when he was fired for that reason. As a result, of the broker’s rebuttal U4 filing FINRA opened an investigation into the former firm, in addition to the representative retaining this firm to pursue a significant breach of contract, wrongful discharge, and defamation claim as his career was ruined by the former firm. In addition, a Dodd Frank Whistleblower claim is being considered. In the end, firms which engage in the practice of attempting to penalize an employee for complaining about securities violations via marking up a broker’s CRD, are playing with fire. However, other issues such as disputes related to personalities, support, bonuses, etc obviously do not raise this type of concern for the firm and as such are more difficult for the representative to deal with and try to correct. If you have an issue with FINRA Brokercheck, your CRD, or a U5 filing by your former employer it behooves you to contact an experienced FINRA attorney. Our FINRA attorneys have over a quarter of a century of legal experience including eleven years in prosecutor’s offices in New York and Manhattan under Eliot Spitzer and Robert Morgenthau. We represent brokers and representatives from all across the country. Contact us for a free phone consultation Nationwide Toll Free 866-764-3100 Or contact us for confidential email consultation. http://www.smeissner.com/ Stuart D. Meissner Esq. End

|

| |||||||||||||||||||||||||||||||||||||||||||||||