Follow on Google News News By Tag Industry News News By Place Country(s) Industry News

Follow on Google News |  Gold Miner Pretivm Resources update as of June 9, 2014Pretivm selling for about $7 has the potential to rise to $91 to $280 per share within 3 - 5 years based on variable gold prices. Here is why this stock is the only gold miner to own after acguiring physical gold and silver in your possession.

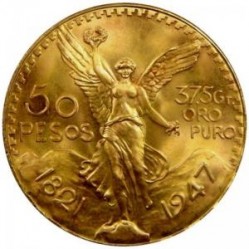

Assay results from all drilling programs to date are outstanding, of which over 35 samples are grading over 1,000 grams per ton of gold. Pretivm will continue to report results as they are received, and has updated the gold mineral resource estimate for their combined Brucejack project (Valley of the Kings and West Zone) to 18.9 Metric tons. Of that amount, Gold is estimated at 7.3 million oz. In addition, their Silver mineral resource estimate for their combined Brucejack project is 35.3 million oz. Due to the Cleopatra Vein and other discoveries (not included above), the potential to dramatically increase reserves in the future is there. Every drill hole finds additional resources to be proven up. In addition, all discoveries to date are open in all directions. Preliminary Cost Per Ton Calculation: The Gold Mining Industry average of "All costs in" includes both mining costs plus all other costs such as administrative, royalties, depletion, etc. usually averages $150 per ton milled. Pretivm's cost as estimated by management are C$156.46 per ton (US$151.60) which is in line. The production estimate of 2,700 tons by management (may be raised in the future if additional discoveries are made) due to additional resources found and additional production anticipated as a result. Preliminary Revenue Per Ton Calculation: I estimate that 10% of mining is from super high grades that approximate 1,000 to 45,000 grams per ton of gold and 1,000 to 13,000 grams per ton of silver. 10% of 2,700 tons = 270 tons at an assigned value (by SFC) of using an average high grade of 1,000 grams of gold, and 1000 grams of silver. The whole mining operation is taken at an average grade of 14.2 grams of gold and silver per ton (silver reserves are less in initial high grade operation). No credits for other mineral resources have been included. Snowfield and other low grade projects have not been included. As a result, 75.8 million oz of gold and 51.0 million oz. of silver at Snowfield have not been included. I believe that 14.2 grams of gold per ton is to low; but we shall see. Earnings Potential: My revised estimates for initial start-up earnings of Pretivm Resources, Inc. in 2016 showed the potential upside for Pretivm is to earn about $3.93 per share for a value of the shares of approximately $91 per share with prices at $1,400 per ounce and silver at $25 per ounce. The shares are currently priced around $7, so that the upside is approximately a 13 fold upside from here. Once resource estimates are updated and a better handle on production is arrived at, together with dramatically higher prices for gold and silver, I believe that a more realistic value per share can be determined. A value of approximately $280 per share within 3-5 years; with higher metal price potential upside once full production is reached after 2016. Higher share values are possible, if my potential medium term prices ($5,000 gold and $333 silver) are realized. If Snowfield and other properties are fully explored and developed, then additional values for Pretivm can be realized. My estimates for gold and silver prices are for them to rise until at least $5,000 gold and $333 silver is attained. Potentially, gold could rise to $12,000 and silver to $806 per ounce in a stressed environment over the long term. These higher prices are not included in my calculations. As a result of these assumptions, I have calculated estimated low-side Pretivm operations to be as follows based on a 350 day underground mining and milling operation per year with production allocation estimated at 50% Gold and 50% Silver of which 10% or 270 tons is very high grade and 90% or 2,430 tons is regular grade accordingly. Silver resources are currently running one to one within higher gold reserves at the present time. By 2016, we estimate that prices will be above $1400 gold and $25 silver. Preliminary Revenues (using $1,400 gold and $25 silver): All in US$. Note: 2,700 tons per day X 14.2 grams per ton = 38,340 grams or 1232.62 troy oz. per day: 1232.62 troy oz. per day of gold (50%) and Silver (50%) per day. Daily Gold Revenue–1232.62 oz. x $1,400 per oz $1,725,666 Daily Silver Revenue –1232.62 oz. x $25 per oz. 30,815 Total Daily Revenues per day of mining operations 1,756,481 Less Total Daily cost of operations or 2,700 tons at $151.50 per ton cash cost or $423 per oz. (521,398) Operating profit per day of mining operations 1,235,085 Taxes estimated rate $0 - 1st 5 years 0 Preliminary Net profit per day of operations 1,235,085 Preliminary Estimated 350 mining days x 350 Estimated Net profit per full year $432,279,750 Estimated # of outstanding shares outstanding 118,828,327 Preliminary Estimated Earnings Per Share $3.64 Estimated PE ratio of 25 (after dilution) $91.00 When you purchase Pretivm you have the best. There is no need for any other paper gold or silver stock. Do your research. I am a CPA (retired), not an advisor and sometimes things do not work out. You must have physical gold and silver in your hands and outside of the banking system. You must not be caught as an unsecured holder of physical or paper shares if the banking system implodes. Accordingly, I recommend that all shares be owned outright and not on margin. If shares can be directly registered in your own name and in your own possession, do so. Visit http://www.SheldonsFinestCoins.com since we can meet all your needs at the lowest prices, best service fast delivery in the industry because we have the lowest overhead in the industry in the USA. See our web-site above for more reasons why you must have gold and silver, other information, updates on Pretivm and other Gold and Silver news. All transactions are kept confidential and are not reportable at this time. Ed Sheldon CPA (retired) President & CEO Sheldon’s Finest Coins http://www.SheldonsFinestCoins.com e-mail is agbug777@SheldonsFinestCoins.com End

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||