Follow on Google News News By Tag Industry News News By Place Country(s) Industry News

Follow on Google News |  What's Happening in the Gold Market (behind the scenes) !Gold is being accumulated by the same players that previously sold the gold markets off and tried to eliminate any enthusiasm that might be brewing by other market players and the public. This is now changing in favor of being long these markets.

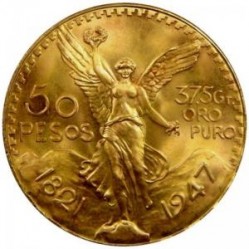

This is an underlining reason why some major banking players in the USA such as JPMorgan, HSBC, Citi, Bank of America and others have been covering their shorts (buying back) positions and now are going net long gold. After all, if gold in their portfolios is now a class one asset why be short when long will not only be profitable but can also help the banks with their capital and liquidity ratios. As a CPA (retired) in charge of all Banks and Financial Institutions in the NY Metropolitan area (NY and NJ) for Touche Ross & Co. (now Deloitte and Touche) as a Managing Director for a period of 8 years during the 1980's, I know from what I speak. It is the reason after 20 years of consulting for major financial firms that I set up Sheldon's Finest Coins to be at the center of the real money conversion that I saw coming. I am always early and that is fine. I just do not want to be even one day late!. Just because the Fed Chairman does not "Understand gold prices, and does not really pretend to understand them either" does not mean that the whole world agrees with him. In fact the rest of the world is moving toward gold in dramatic fashion as seen in the physical markets for gold. The US Comex and related players have lost about 25% of their physical gold from withdrawals during the past 6 months. This suggests to me that market players in the know want real money in their possession and not the paper fiat anymore. The suggestion is that you should want real money gold also in your possession. This is confirmed by real shortages and lagging wait times for physical gold and silver assets. In time (shorter than you think) the prices that I see are coming down the road. The timing for such an event to really trigger an upward long lasting spike cannot be known in advance by us. Only the market managers will know when. It may be an audit of the US gold reserves (which may no longer exist), an unknown banking event or holiday, the Banking Buy-ins rules currently being discussed but not yet implemented in the US, but now currently spreading throughout Europe, Canada, Japan and elsewhere. Time is running short for the price to explode, since the gold assets in the US are depleting fast and moving to the Far East and elsewhere. At the current pace, gold will not available in the US markets by year-end or in early 2014. Secure your gold now while you still can. Stay posted and send your comments to me by return e-mail at agbug777@SheldonsFinestCoins.com or call me to discuss at 1-888-786-5678. All the best, Ed Sheldon CPA (retired) End

|

| |||||||||||||||||||||||||||||||||||||||||||||||