Follow on Google News News By Tag Industry News News By Location Country(s) Industry News

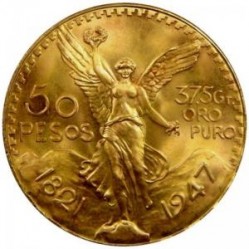

Follow on Google News |  Gold and Silver in Bonanza Grades at Pretivm Resources (PVG)Pretium has the potential to produce over $19.80 in earnings (after tax) x 25 PE ratio = $495 per share. The shares are currently priced around $16-$17. See periodic updates at SheldonsFinestCoins.com

By: Ed Sheldon CPA “Ongoing drilling in the Valley of the Kings Zone continues to demonstrate the continuity of high-grade gold mineralization.” -- Hole SU-260 intersected 0.5 meters with uncut grades of 17,750 grams of gold and 7,780 grams of silver per tonne (1.6 feet averaging 517.7 ounces gold and 226.9 ounces of silver per ton); -- Hole SU-249 intersected 0.5 meters with uncut grades of 3,880 grams of gold and 1,745 grams of silver per tonne (1.6 feet averaging 113.2 ounces gold and 50.9 ounces silver per ton); -- Hole SU-239 intersected 1.0 meter with uncut grades of 3,460 grams of gold and 1,515 grams of silver per tonne (3.3 feet averaging 100.9 ounces gold and 44.2 ounces silver per ton). Assay results for 26 holes from the 2011 drill program are outstanding, of which 18 are for the Valley of the Kings Zone. Pretivm will continue to report results as they are received, and will update the mineral resource estimate for Brucejack this quarter. As a result of these additional resource findings (directly from the Pretium website), I have updated my previous rough estimates which in my opinion are the best estimates available at this time are calculated as follows: Preliminary Cost Per Ton Calculation: The Gold Mining Industry average of "All costs in" includes both mining costs plus all other costs such as administrative, royalties, depletion, etc. usually averages below $150 per ton mined. Pretium's cost should be lower, but I have used this $150 per ton cost. Estimates include reference to an initial 1,500 ton per day mill and mining operation. I have raised production to 2,500 tons per day (see below). Preliminary Revenue Per Ton Calculation: I estimate that 10% of mining is from super high grades that approximate 1,000 to 18,000 grams per ton of gold and 1,000 to 9,000 grams per ton of silver. 10% of 2,500 tons = 250 tons at a minimum assigned value (by SFC) of 1,000 grams of gold and silver. I am using the lower cut-off grade of 1,000 grams to be conservative. I estimate that 90% of the remaining mining operation was taken at an average of 5 grams of gold equivalent per ton. As a result of these assumptions, I have calculated estimated Pretium operations to be as follows based on a 350 day underground mining and milling operation per year with production allocation estimated at 60% Gold and 40% Silver. With continued high grades for both gold and Silver, I am raising my estimates of total mining, milling and overall production from 1,500 tons to 2,500 tons per day. This estimate has not been raised by management as of this date. Preliminary Revenues (using $1,700 gold and $30 silver): 10% very high grade mining or 250 tons at 1,000 grams / 32.15 grams = 31.1 oz. per ton of which 60% is gold or 150 tons x $1,700 per oz = $7,930,500 and 40% is silver or 100 tons x $30 per oz. = 93,300Total of very high grade operation of 250 tons per day = $8,023,800 90% of regular grade mining, 2,250 tons at 5 grams / 32.15 grams or 0.15552 oz. per ton of which 60% is gold,1,350 tons x $1,700 per oz. 356,918 and 40% is silver or 900 tons x $30 per oz. = 4,199 Total of regular grade operation per day of 2,250 tons per day = 361,117 Total revenue per day from combined mining operation = $8,384,917 Total Costs of operations or 2,500 tons at $150 per ton per day (375,000) Operating profit per day of mining operations of $8,009,917 Taxes (after recovery of all costs in years 3-5) at 35% est. rate (2,803,471) Preliminary Net profit per day of $5,206,446 Preliminary Estimated 350 mining days per year

Estimated Net profit per year of $1,822,256,100 Estimated # of outstanding shares outstanding 92,030,086 Preliminary Estimated Earnings Per Share after Taxes of $19.80 Estimated PE ratio of 25 (could be from 20 to 30) of $ 495.00 Do your research. I am a CPA (retired), not an advisor and sometimes things do not work out. You must have physical gold and silver in your hands and outside of the banking system. You must not be caught as an unsecured holder of physical or paper shares if the banking system implodes. Visit http://www.SheldonsFinestCoins.com since we can meet all your needs at the lowest prices in the industry. We have the lowest overhead in the industry in the USA. See our web-site above for more reasons why you must have gold and silver, other information, updates on Pretium and news. All transactions are keep confidential and are not reportable. All the best, with a little glitter and shine in your life, Ed Sheldon CPA(retired) President & CEO Sheldon’s Finest Coins http://www.SheldonsFinestCoins.com # # # Ed Sheldon started his career with Arthur Andersen & Co.He moved on to Deloitte & Touche (Touche Ross & Co.) where he became a Managing Director in charge of all Banks and Financial Service companies. After 8 years, Ed left to start his own Management Consulting firm to help companies in trouble.After 20 years, Ed decided that he wanted to start a new firm named Sheldon’s Finest Coins to provide both a service and low cost ways to purchase real monetary assets that cannot be corrupted by the current state of “Fiat Currencies” throughout the world. In just 2 years Sheldon’s Finest Coins has become one of the low cost providers to entities that want to acquire Precious Metals in size on a confidential basis. Sheldon’s Finest Coins are also a source for those entities that want to sell or exchange one form of hard asset into another (Gold into Silver as an example). See Testimonials included within the Sheldon’s Finest Coins website. End

Page Updated Last on: Dec 24, 2012

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||